Liberation Day

|

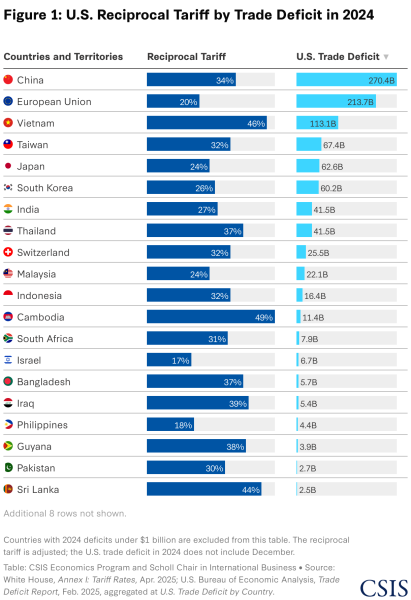

On Wednesday, April 2, President Trump signed an executive order that shocked the economy and global market. Sweeping tariffs were imposed, with a minimum of 10% on all U.S. imports starting April 5 and higher “reciprocal” tariffs for about 90 nations starting April 9. Heavily targeted by this was China, which currently has a tariff rate over 100%. Following the announcement, reactions of outrage were received from other countries, while the American public dwells in uncertainty. Some Americans see them as necessary, while others see them as unreasonable and too aggressive. Debates have also ensued over whether the current economic volatility will pass or worsen with time.

The Breakdown

The Breakdown

A “tariff” is a tax imposed on imported goods, essentially making those goods more expensive for companies and consumers. The idea is to prioritize domestic markets and goods, incentivizing economic growth. Tariffs are a part of foreign policy and often specific to different counties. A “retaliatory tariff” is a tariff one country makes on a foreign country in response to one placed on them. For this reason, tariffs can be destabilizing and detrimental on the global scale; they can lead to trade wars between nations, as well as economic slowdown and inflation in the countries involved.

But Why?

Trump claims new taxes are needed to reduce the trade deficit between the U.S. and other countries. The tariffs will draw factories and jobs back home, encouraging manufacturing and industrial capacity. He labels his high tariffs as reciprocal because the countries he places them on already have tariffs on us: “that means they do it to us, and we do it to them.” Additionally, he claims the U.S. has been taken advantage of because it has a more open market than other countries.

In the case of China, a trade war has been ongoing since 2018. The Trump administration placed tariffs in hopes China would change what the U.S. stated were unfair trade practices and intellectual property violations. The two nations have been stacking tariffs on each other since Trump’s first presidency, and before Liberation Day, the import tariff on China was 54%.

Softening the Blow

Immediately following the tariffs, countries like Canada, the European Union, and China all announced intentions to retaliate. There were also implications of China, South Korea, and Japan working together against the new tariffs, a surprising action given their history. China retaliated by raising their tariffs from 34% to 84%. E.U member states responded with retaliatory tariffs of 25%. On April 9, Trump announced a 90-day pause on most of the new tariffs and a softening of reciprocal tariffs to 10% for countries who did not retaliate. The exception was China, which had tariffs raised to 125% and later 145% total. China then imposed a 125% tariff in response, but announced they will ignore further tariffs from the U.S. as it has already become impossible for the Chinese economy to accept U.S. imports at the current level.

What This Means for You

So, what does this actually mean for the economy? Your guess is as good as mine. Ideally, the tariffs will stimulate the economy, and the administration has predicted a revenue in the trillions. However, the situation becomes more complex with the high risk of regression, which would hit especially hard for low-income families. For most of Gen-Z, the impacts of the tariffs will be seen in the products we consume. Use an iPhone? Play Nintendo? Like buying new clothes? Many common products will be affected, and if not now, certainly after the 90-day pause. Invest in stocks? The stock market is extremely volatile at the moment due to the tariff changes, experiencing an initial S&P drop followed by a significant rebound. It may be risky to invest in the short-term but there is promise in the long-term. Overall, all there is to do now is to stay informed on further news and see effects take place. We’ll be sure to keep you updated.

More questions? These go into a more in depth overview of the tariffs and are the sources used for this article:

https://www.csis.org/analysis/liberation-day-tariffs-explained https://www.hks.harvard.edu/faculty-research/policy-topics/public-finance/explainer-how-do-tariffs-work-and-how-will-they?utm_source=join1440&utm_medium=email&utm_placement=newsletter&user_id=66c4c0545d78644b3aaacae8 https://budgetmodel.wharton.upenn.edu/issues/2025/4/10/economic-effects-of-president-trumps-tariffs https://www.cbsnews.com/amp/news/trump-reciprocal-tariffs-liberation-day-list/ https://en.m.wikipedia.org/wiki/China-United_States_trade_war https://www.theguardian.com/us-news/2025/apr/09/trump-tariffs-pause-china